46+ what credit score do lenders use for mortgage

500 if you can put down 10. However if you have a good credit score from one of the main credit reporting reference agencies such as Experian you are likely to have a good credit score with your lender.

What Credit Score Is Needed For A Mortgage Mintlife Blog

620 Jumbo loan.

. Web Minimum credit score. Web The minimum credit score needed for most mortgages is typically around 620. Fannie and Freddie Mac generally dont lend to borrowers with scores below 620.

Experian Equifax and TransUnion. Frequently Asked Questions Which credit report is. If your three FICO scores were 700 709 and 730 the lender would use the 709 as the basis for its decision.

Web The lowest credit score that will qualify you for a mortgage depends on the type of home loan you use and the lender you apply to. FICO Score 4 Industry-specific scores are fine-tuned based on the specific risks of each industry. FICO Score 5 TransUnion.

Each credit bureau uses a different FICO model to determine your credit score. However government-backed mortgages like Federal Housing Administration FHA loans typically have lower credit requirements than conventional fixed-rate loans and adjustable rate mortgages ARMs. The specific scores used by each bureau are as follows.

This is when it might make more sense to apply on your own. We outline the models used by the credit bureaus below. Web Mortgage lenders will often get a single report that contains your credit reports from each of the three credit bureaus and the associated FICO Scores.

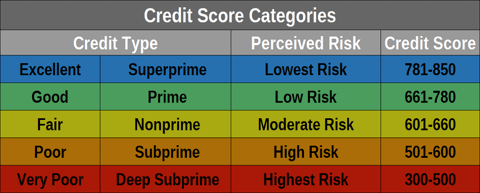

Web The minimum credit score needed to buy a house could be as low as 580 but could be as high as 640. Web The credit score you need to get a mortgage varies as theres no one credit score or universal magic number. Web Applicants with scores of 740 or higher generally get the lowest interest rates.

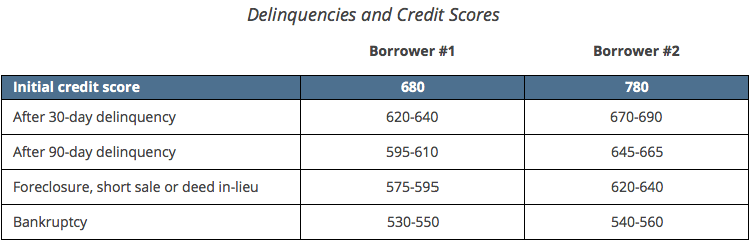

How does your credit score affect your mortgage application. Web To qualify for a conforming loan most lenders require a DTI of 43 or lower. Web According to FICO the current interest rate for a 30-year fixed mortgage is 2377 APR for a 760 borrower and 3966 for a borrower with a score between 620 and 639 which is considered.

Mortgage lenders who offer conventional mortgages are required to use a FICO Score when they underwrite your loan application for approval. Web Used by more than 90 of lenders according to the company the scores are designed to help assess a borrowers creditworthiness. Theyre often one of the few financing options for.

However mortgage lenders typically use data from all three. For the three months ending 2022 the average rate it paid on bank deposits was just 046 whereas the federal funds rate. No minimum but scores above 640 are most successful with lenders.

Web Which Credit Scores Are Mortgage Lenders Primarily Interested In. Web Minimum Credit Score Required by Mortgage Loan Type Different mortgage types have different minimum score requirements. A FICO Score 2 based on Experian data a FICO Score 5 based on Equifax data and a FICO Score 4 based on TransUnion data.

FICO Score 2 or ExperianFair Isaac Risk Model v2. Web When you apply for a mortgage lenders typically pull your credit report from the three main credit bureaus. How to get started.

Web Most mortgage lenders use the FICO Credit Scores 2 4 or 5 when assessing applicants. Web And in a process that only exists in mortgage lending the lender bases its decision not on your highest credit score not on your lowest score but rather on the middle numeric score. It may base the lending decision on your middle credit score or if youre applying jointly.

This is sometimes known as the 43 rule DTI rules are. Web The most widely used version is FICO Score 8 but the most frequently used versions in mortgage lending are. Increase Your Credit Score About Us.

FICO Score 4 or TransUnion. Web Its recommended you have a credit score of 620 or higher when you apply for a conventional loan. Mortgage lenders use a FICO score to determine your creditworthiness.

If your score is below 620 lenders either wont be able to approve your loan or may be required to offer you a higher interest rate which can result in higher monthly payments. 580 if you want to put down 35. Mortgage loans backed by federal programs have strict eligibility guidelines including credit score requirements.

As mentioned above 620 is typically the minimum credit score required for a conventional mortgage but you might be able to secure financing with a lower credit score. FICO Score 5 or Equifax Beacon 5. Web When applying jointly lenders use the lowest credit score of the two borrowers.

620 Highest mortgage rates. FHA and VA loans for example require a minimum score of 580 to qualify while a USDA loan requires a minimum of 640. Web Most lenders use a FICO Score based on data from just one of the three credit bureaus.

The higher your credit score the better interest rate youre likely to get which also means youll have a lower monthly mortgage payment. TransUnion Equifax and Experian will each provide a credit score for the lender when they are determining your chances of loan approval. FICO Score 2 Equifax.

3 FICO considers five factors when calculating a score. Web The FICO scores that mortgage lenders commonly use according to Experian are. Three credit bureaus Equifax Experian and TransUnion calculate an individuals credit score.

Web The minimum credit score required for a mortgage approval is ultimately determined by the lender but score requirements also can depend heavily on the type of mortgage youre seeking. So if your median score is a 780 but your partners is a 620 lenders will base interest rates off that lower score. If your score is lower than that youll.

Web Lenders use credit scores to determine a borrowers level of risk. So ideally you want to keep yours below that mark. Web 13 hours agoBest Mortgage Lenders.

Jumbo loans are conventional mortgages that dont conform to loan limits set forth by Fannie Mae or Freddie Mac.

What Credit Score Is Needed For A Mortgage Compass Mortgage

The Average Credit Score To Qualify For A Mortgage Is Now Very High

Credit Score Requirements To Buy A House 2023 Guide

This Is The Credit Score You Need To Buy A House Gobankingrates

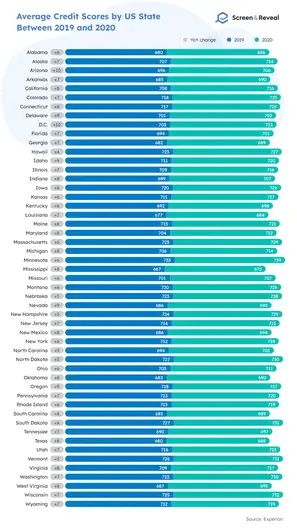

46 Credit Score Statistics And Faqs For 2022 Screen And Reveal

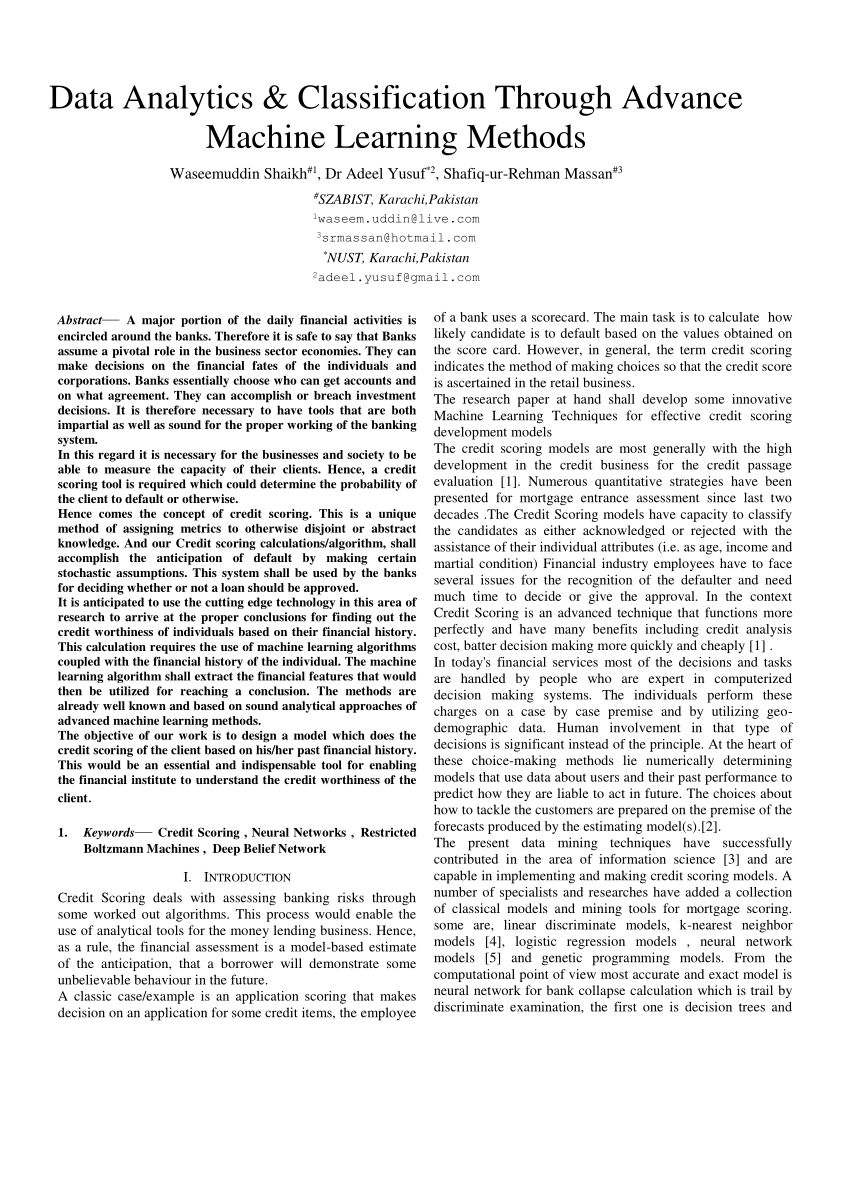

Pdf Data Analytics Classification Through Advanced Machine Learning Methods

Which Credit Score Do Mortgage Lenders Use

Which Fico Score Do Mortgage Lenders Use Current Year Badcredit Org

Pdf Credit Risk Scorecards Developing And Implementing Intelligent Credit Scoring Karamfila Stoykova Academia Edu

What Credit Score Is Needed To Buy A House

The Average Credit Score To Qualify For A Mortgage Is Now Very High

What Credit Score Is Needed To Buy A House

Qualifying Credit Score For Mortgage Used By Lenders

What Credit Score Is Needed For A Mortgage Mintlife Blog

What Credit Score Is Needed To Buy A Home

Minimum Credit Score For Mortgage March 2023

What Fico Credit Score Do Mortgage Lenders Use Belay Mortgage Group